Which Of The Following Hypothetical Examples Would Be A Restriction On The Import Of Services?

Learning Objectives

After reading this section, students should be able to …

- Define international trade.

- Compare and contrast different trade theories.

- Determine which international trade theory is most relevant today and how it continues to evolve.

Opening Instance: China in Africa

Strange companies have been doing business organisation in Africa for centuries. Much of the trade history of past centuries has been colored past European colonial powers promoting and preserving their economic interests throughout the African continent.1 After Earth War II and since independence for many African nations, the continent has not fared too as other erstwhile colonial countries in Asia. Africa remains a continent plagued by a continued combination of factors, including competing colonial political and economic interests; poor and corrupt local leadership; war, famine, and disease; and a chronic shortage of resources, infrastructure, and political, economic, and social will.2 And even so, through the bleak assessments, progress is emerging, led in large part past the successful emergence of a free and locally powerful South Africa. The continent generates a lot of interest on both the corporate and humanitarian levels, too as from other countries. In particular in the by decade, Africa has caught the interest of the world's second largest economy, China.3

At home, over the by few decades, Red china has undergone its ain miracle, managing to move hundreds of millions of its people out of poverty by combining state intervention with economic incentives to concenter private investment. Today, Communist china is involved in economic engagement, bringing its success story to the continent of Africa. As professor and author Deborah Brautigam notes, China'southward "current experiment in Africa mixes a hard-nosed but clear-eyed self-interest with the lessons of China's own successful development and of decades of its failed aid projects in Africa." 4

According toCNN, "China has increasingly turned to resources-rich Africa as Cathay's booming economy has demanded more and more oil and raw materials."five Merchandise between the African continent and China reached $106.8 billion in 2008, and over the past decade, Chinese investments and the country's development aid to Africa have been increasing steadily."China-Africa Trade upwardly 45 percent in 2008 to $107 Billion," 6 "Chinese activities in Africa are highly diverse, ranging from government to government relations and large country endemic companies (SOE) investing in Africa financed past Mainland china's policy banks, to private entrepreneurs inbound African countries at their own initiative to pursue commercial activities."7

Since 2004, eager for admission to resources, oil, diamonds, minerals, and commodities, China has entered into arrangements with resource-rich countries in Africa for a total of almost $14 billion in resource deals alone. In one example with Angola, People's republic of china provided loans to the country secured past oil. With this investment, Angola hired Chinese companies to build much-needed roads, railways, hospitals, schools, and water systems. Similarly, China provided nearby Nigeria with oil-backed loans to finance projects that utilise gas to generate electricity. In the Republic of the Congo, Chinese teams are building a hydropower projection funded by a Chinese government loan, which will be repaid in oil. In Republic of ghana, a Chinese government loan will be repaid in cocoa beans.8

The Export-Import Bank of Communist china (Ex-Im Bank of Communist china) has funded and has provided these loans at market rates, rather than as foreign aid. While these loans certainly promote development, the gamble for the local countries is that the Chinese bids to provide the work aren't competitive. Furthermore, the benefit to local workers may be diminished as Chinese companies bring in some of their own workers, keeping local wages and working standards low.

In 2007, the UNCTAD (Un Conference on Trade and Development) Printing Function noted the post-obit:

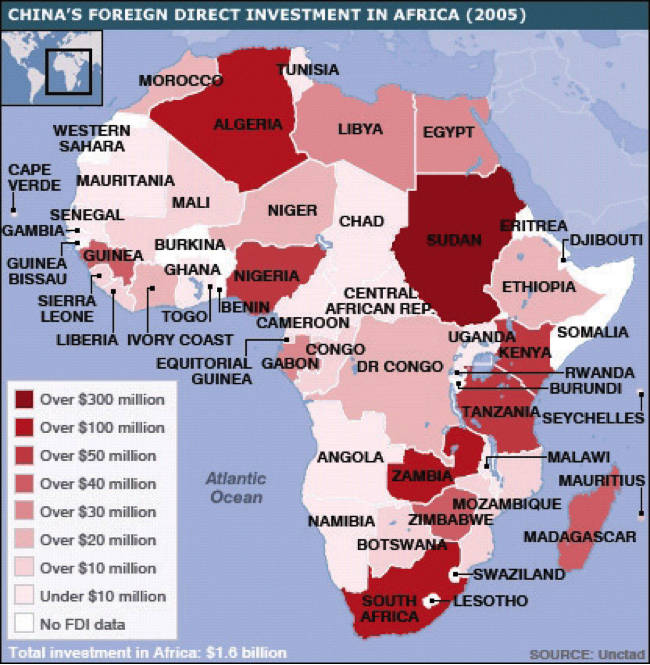

Over the past few years, China has get one of Africa´south important partners for trade and economic cooperation. Merchandise (exports and imports) between Africa and Prc increased from Usa$11 billion in 2000 to US$56 billion in 2006….with Chinese companies present in 48 African countries, although Africa withal accounts for simply 3 percent of Red china´southward outward FDI [foreign directly investment]. A few African countries have attracted the majority of China´s FDI in Africa: Sudan is the largest recipient (and the 9th largest recipient of Chinese FDI worldwide), followed by Algeria (18th) and Republic of zambia (19th).nine

Observers annotation that African governments can larn from the evolution history of China and many Asian countries, which now savor high economic growth and upgraded industrial activeness. These Asian countries made strategic investments in education and infrastructure that were crucial not only for promoting economic development in general but also for alluring and benefiting from efficiency-seeking and export-oriented FDI.10

Source: "Cathay in Africa: Developing Ties," BBC News, terminal updated Nov 26, 2007, accessed June 3, 2011, http://news.bbc.co.uk/2/hello/africa/7086777.stm .

Criticized by some and applauded by others, it's articulate that Cathay'southward investment is encouraging development in Africa. China is accused past some of ignoring human rights crises in the continent and doing concern with repressive regimes. China's success in Africa is due in large part to the local political environment in each country, where either ane or a small handful of leaders often control the power and decision making. While the countries oft open bids to many strange investors, Chinese firms are able to provide low-cost options thanks in large part to their government's project support. The ability to forge a government-level partnership has enabled Chinese businesses to have long-term investment perspectives in the region. China even hosted a summit in 2006 for African leaders, pledging to increment trade, investment, and aid over the coming decade.xi The 2008 global recession has led China to be more selective in its African investments, looking for good deals besides as political stability in target countries. Nonetheless, whether to access the region's rich resources or develop local markets for Chinese appurtenances and services, Cathay intends to exist a key foreign investor in Africa for the foreseeable future.12

What Is International Trade?

International trade theories are simply different theories to explain international trade. Merchandise is the concept of exchanging goods and services between 2 people or entities.International trade is then the concept of this commutation betwixt people or entities in two unlike countries.

People or entities merchandise because they believe that they benefit from the exchange. They may need or desire the goods or services. While at the surface, this many sound very simple, at that place is a neat deal of theory, policy, and business organisation strategy that constitutes international trade.

"Effectually 5,200 years ago, Uruk, in southern Mesopotamia, was probably the first metropolis the world had always seen, housing more than 50,000 people within its six miles of wall. Uruk, its agriculture made prosperous by sophisticated irrigation canals, was habitation to the first class of middlemen, trade intermediaries…A cooperative trade network…set the pattern that would suffer for the next six,000 years."thirteen

Mercantilism

Developed in the sixteenth century, mercantilism was one of the primeval efforts to develop an economic theory. This theory stated that a country's wealth was determined by the amount of its golden and argent holdings. In information technology'due south simplest sense, mercantilists believed that a country should increase its holdings of gold and silvery by promoting exports and discouraging imports. In other words, if people in other countries buy more from you (exports) than they sell to you (imports), so they have to pay you the difference in gold and silverish. The objective of each state was to have a trade surplus, or a situation where the value of exports are greater than the value of imports, and to avoid a trade deficit, or a situation where the value of imports is greater than the value of exports.

A closer await at globe history from the 1500s to the late 1800s helps explain why mercantilism flourished. The 1500s marked the rising of new nation-states, whose rulers wanted to strengthen their nations by building larger armies and national institutions. By increasing exports and trade, these rulers were able to amass more golden and wealth for their countries. I way that many of these new nations promoted exports was to impose restrictions on imports. This strategy is called protectionism and is still used today.

Nations expanded their wealth past using their colonies effectually the earth in an effort to command more trade and amass more riches. The British colonial empire was one of the more successful examples; it sought to increase its wealth by using raw materials from places ranging from what are now the Americas and Bharat. France, the Netherlands, Portugal, and Spain were likewise successful in building large colonial empires that generated extensive wealth for their governing nations.

Although mercantilism is ane of the oldest trade theories, it remains part of mod thinking. Countries such as Japan, China, Singapore, Taiwan, and even Germany still favor exports and discourage imports through a form of neo-mercantilism in which the countries promote a combination of protectionist policies and restrictions and domestic-manufacture subsidies. Nearly every country, at 1 point or another, has implemented some course of protectionist policy to guard cardinal industries in its economy. While consign-oriented companies usually back up protectionist policies that favor their industries or firms, other companies and consumers are hurt by protectionism. Taxpayers pay for government subsidies of select exports in the grade of higher taxes. Import restrictions atomic number 82 to higher prices for consumers, who pay more for foreign-made goods or services. Free-trade advocates highlight how gratuitous trade benefits all members of the global community, while mercantilism's protectionist policies merely benefit select industries, at the expense of both consumers and other companies, within and exterior of the industry.

Accented Advantage

In 1776, Adam Smith questioned the leading mercantile theory of the time inThe Wealth of Nations.Adam Smith,An Research into the Nature and Causes of the Wealth of Nations (London: Due west. Strahan and T. Cadell, 1776). Recent versions have been edited by scholars and economists. Smith offered a new trade theory called absolute advantage, which focused on the ability of a land to produce a good more efficiently than some other nation. Smith reasoned that trade between countries shouldn't be regulated or restricted past government policy or intervention. He stated that trade should flow naturally co-ordinate to market place forces. In a hypothetical two-land world, if Country A could produce a good cheaper or faster (or both) than Land B, then Country A had the advantage and could focus on specializing on producing that good. Similarly, if Country B was better at producing another adept, it could focus on specialization besides. By specialization, countries would generate efficiencies, because their labor force would get more skilled past doing the same tasks. Product would also become more efficient, because at that place would be an incentive to create faster and improve production methods to increment the specialization.

Smith's theory reasoned that with increased efficiencies, people in both countries would benefit and trade should be encouraged. His theory stated that a nation's wealth shouldn't be judged by how much gold and silver it had but rather by the living standards of its people.

Comparative Advantage

The claiming to the absolute reward theory was that some countries may be ameliorate at producing both goods and, therefore, have an advantage inmany areas. In dissimilarity, another country may not takeany useful absolute advantages. To respond this challenge, David Ricardo, an English economist, introduced the theory of comparative advantage in 1817. Ricardo reasoned that fifty-fifty if Land A had the accented advantage in the production ofboth products, specialization and merchandise could still occur between two countries.

Comparative advantage occurs when a country cannot produce a product more efficiently than the other country; however, itcan produce that product better and more efficiently than it does other appurtenances. The difference between these ii theories is subtle. Comparative advantage focuses on the relative productivity differences, whereas absolute advantage looks at the accented productivity.

Let'due south expect at a simplified hypothetical example to illustrate the subtle difference between these principles. Miranda is a Wall Street lawyer who charges $500 per hour for her legal services. Information technology turns out that Miranda tin can also type faster than the authoritative assistants in her role, who are paid $40 per hour. Even though Miranda clearly has the absolute advantage in both skill sets, should she do both jobs? No. For every hour Miranda decides to type instead of do legal work, she would be giving up $460 in income. Her productivity and income will be highest if she specializes in the higher-paid legal services and hires the near qualified administrative banana, who can blazon fast, although a petty slower than Miranda. By having both Miranda and her banana concentrate on their respective tasks, their overall productivity every bit a squad is higher. This is comparative advantage. A person or a land will specialize in doing what they dorelatively better. In reality, the world economy is more than complex and consists of more than ii countries and products. Barriers to trade may exist, and goods must be transported, stored, and distributed. Nevertheless, this simplistic example demonstrates the footing of the comparative advantage theory.

Modern or Business firm-Based Trade Theories

In contrast to classical, state-based merchandise theories, the category of modern, firm-based theories emerged afterwards World War II and was developed in big function by business organisation school professors, not economists. The firm-based theories evolved with the growth of the multinational visitor (MNC). The country-based theories couldn't fairly address the expansion of either MNCs or intraindustry trade, which refers to trade between ii countries of goods produced in the same industry. For example, Japan exports Toyota vehicles to Germany and imports Mercedes-Benz automobiles from Federal republic of germany.

Unlike the land-based theories, business firm-based theories contain other product and service factors, including brand and customer loyalty, engineering science, and quality, into the agreement of merchandise flows.

State Similarity Theory

Swedish economist Steffan Linder developed the state similarity theory in 1961, equally he tried to explain the concept of intraindustry merchandise. Linder'south theory proposed that consumers in countries that are in the same or similar stage of development would have similar preferences. In this firm-based theory, Linder suggested that companies first produce for domestic consumption. When they explore exporting, the companies frequently find that markets that look similar to their domestic ane, in terms of client preferences, offer the most potential for success. Linder's state similarity theory and then states that well-nigh trade in manufactured goods will be betwixt countries with similar per capita incomes, and intraindustry trade will be mutual. This theory is often near useful in understanding trade in goods where brand names and product reputations are important factors in the buyers' decision-making and purchasing processes.

Product Life Cycle Theory

Raymond Vernon, a Harvard Business School professor, developed the product life cycle theory in the 1960s. The theory, originating in the field of marketing, stated that a product life wheel has three distinct stages: (1) new production, (2) maturing product, and (3) standardized production. The theory causeless that production of the new production will occur completely in the domicile country of its innovation. In the 1960s this was a useful theory to explicate the manufacturing success of the United States. United states manufacturing was the globally dominant producer in many industries after Globe War II.

Information technology has also been used to depict how the personal computer (PC) went through its product bike. The PC was a new product in the 1970s and developed into a mature product during the 1980s and 1990s. Today, the PC is in the standardized product stage, and the majority of manufacturing and production process is done in depression-cost countries in Asia and Mexico.

The product life cycle theory has been less able to explicate electric current trade patterns where innovation and manufacturing occur around the world. For example, global companies even conduct research and evolution in developing markets where highly skilled labor and facilities are usually cheaper. Fifty-fifty though research and development is typically associated with the commencement or new product stage and therefore completed in the home country, these developing or emerging-market place countries, such equally Republic of india and China, offer both highly skilled labor and new inquiry facilities at a substantial cost reward for global firms.

Global Strategic Rivalry Theory

Global strategic rivalry theory emerged in the 1980s and was based on the work of economists Paul Krugman and Kelvin Lancaster. Their theory focused on MNCs and their efforts to gain a competitive advantage confronting other global firms in their industry. Firms will see global competition in their industries and in lodge to prosper, they must develop competitive advantages. The disquisitional means that firms tin can obtain a sustainable competitive reward are chosen the barriers to entry for that manufacture. The barriers to entry refer to the obstacles a new firm may confront when trying to enter into an industry or new market. The barriers to entry that corporations may seek to optimize include:

- research and development,

- the ownership of intellectual belongings rights,

- economies of calibration,

- unique concern processes or methods as well as extensive experience in the industry, and

- the command of resources or favorable access to raw materials.

Porter'south National Competitive Advantage Theory

In the continuing development of international merchandise theories, Michael Porter of Harvard Business organization School adult a new model to explain national competitive advantage in 1990. Porter's theory stated that a nation'south competitiveness in an industry depends on the capacity of the industry to introduce and upgrade. His theory focused on explaining why some nations are more competitive in certain industries. To explain his theory, Porter identified four determinants that he linked together. The four determinants are (one) local market resources and capabilities, (2) local market demand conditions, (3) local suppliers and complementary industries, and (4) local firm characteristics.

- Local market place resource and capabilities (cistron atmospheric condition). Porter recognized the value of the factor proportions theory, which considers a nation'due south resources (due east.g., natural resources and available labor) as key factors in determining what products a country volition import or export. Porter added to these basic factors a new listing of avant-garde factors, which he divers as skilled labor, investments in educational activity, engineering science, and infrastructure. He perceived these advanced factors equally providing a state with a sustainable competitive advantage.

- Local marketplace demand conditions. Porter believed that a sophisticated domicile marketplace is critical to ensuring ongoing innovation, thereby creating a sustainable competitive advantage. Companies whose domestic markets are sophisticated, trendsetting, and demanding forces continuous innovation and the development of new products and technologies. Many sources credit the demanding United states consumer with forcing U.s.a. software companies to continuously innovate, thus creating a sustainable competitive reward in software products and services.

- Local suppliers and complementary industries. To remain competitive, large global firms do good from having potent, efficient supporting and related industries to provide the inputs required past the industry. Certain industries cluster geographically, which provides efficiencies and productivity.

- Local firm characteristics. Local business firm characteristics include business firm strategy, manufacture structure, and industry rivalry. Local strategy affects a house'southward competitiveness. A healthy level of rivalry between local firms will spur innovation and competitiveness.

In addition to the four determinants of the diamond, Porter also noted that government and chance play a part in the national competitiveness of industries. Governments tin, by their actions and policies, increment the competitiveness of firms and occasionally entire industries.

Porter'south theory, along with the other modern, firm-based theories, offers an interesting estimation of international trade trends. Nevertheless, they remain relatively new and minimally tested theories.

REFERENCES

1. Martin Meredith, The Fate of Africa (New York: Public Diplomacy, 2005).

ii. "Why Africa Is Poor: Ghana Beats Upward on Its Biggest Foreign Investors," Wall Street Journal, Feb 18, 2010, accessed Feb 16, 2011, http://online.wsj.com/article/SB10001424052748704804204575069511746613890.html .

3. Andrew Rice, "Why Is Africa Still Poor?," The Nation, October 24, 2005, accessed Dec twenty, 2010, http://www.thenation.com/article/why-africa-even so-poor?page=0,one .

four. Deborah Brautigam, "Africa's Eastern Hope: What the Due west Tin Learn from Chinese Investment in Africa," Foreign Affairs, January 5, 2010, accessed December xx, 2010, http://www.foreignaffairs.com/manufactures/65916/deborah-brautigam/africa%E2%80%99s-eastern-promise .

5. "China: Trade with Africa on Track to New Tape," CNN, Oct xv, 2010, accessed April 23, 2011, http://articles.cnn.com/2010-10-fifteen/world/prc.africa.trade_1_china-and-africa-link-trade-largest-trade-partner?_s=PM:Globe .

6. China Daily, February 11, 2009, accessed Apr 23, 2011, http://www.chinadaily.com.cn/china/2009-02/eleven/content_7467460.htm .

7. Tracy Hon, Johanna Jansson, Garth Shelton, Liu Haifang, Christopher Shush, and Carine Kiala, Evaluating Cathay'southward FOCAC Commitments to Africa and Mapping the Way Alee(Stellenbosch, South Africa: Centre for Chinese Studies, University of Stellenbosch, 2010), ane, accessed December 20, 2010, http://www.ccs.org.za/wp-content/uploads/2010/03/English language-Evaluating-Chinas-FOCAC-commitments-to-Africa-2010.pdf .

8. Deborah Brautigam, "Africa's Eastern Promise: What the West Tin Learn from Chinese Investment in Africa," Foreign Diplomacy, January five, 2010, accessed December twenty, 2010, http://www.foreignaffairs.com/manufactures/65916/deborah-brautigam/africa%E2%80%99s-eastern-promise .

9. United Nations Briefing on Trade and Development, "Asian Strange Direct Investment in Africa: Un Report Points to a New Era of Cooperation among Developing Countries," press release, March 27, 2007, accessed December twenty, 2010, http://www.unctad.org/Templates/Webflyer.asp?docID=8172&intItemID=3971&lang=one .

10. United Nations Briefing on Trade and Development, "Foreign Directly Investment in Africa Remains Buoyant, Sustained by Involvement in Natural Resources," press release, September 29, 2005, accessed December 20, 2010, http://news.bbc.co.uk/2/hullo/africa/7086777.stm .

xi. "Summit Shows Communist china'due south Africa Ascendancy," BBC News, November half-dozen, 2006, accessed December xx, 2010, http://news.bbc.co.united kingdom/two/hi/business organization/6120500.stm .

12. "China in Africa: Developing Ties," BBC News, November 26, 2007, accessed December 20, 2010, http://news.bbc.co.uk/2/hi/africa/7086777.stm .

13. Matt Ridley, "Humans: Why They Triumphed,"Wall Street Journal, May 22, 2010, accessed December 20, 2010, http://online.wsj.com/article/SB10001424052748703691804575254533386933138.html.

The higher up content was adapted under a Creative Commons Attribution-NonCommercial-ShareAlike iii.0 License without attribution every bit requested by the piece of work's original creator or licensor.

I would like to thank Andy Schmitz for his work in maintaining and improving the HTML versions of these textbooks. This textbook is adapted from his HTML version, and his project can be constitute here.

Which Of The Following Hypothetical Examples Would Be A Restriction On The Import Of Services?,

Source: https://opentext.wsu.edu/cpim/chapter/2-1-international-trade/

Posted by: bratcherwithile1984.blogspot.com

0 Response to "Which Of The Following Hypothetical Examples Would Be A Restriction On The Import Of Services?"

Post a Comment